Please update your browser.

COVID-19大流行对美国人的生活造成了广泛和长期的破坏.S. since a national emergency was declared on March 13, 2020. 小企业在最初几个月的收入大幅下降. Expenses also declined commensurately, 这反映了收入的减少以及保持流动性的努力. 小企业的标志性项目是工资保护计划(PPP), 从2020年到2021年,到2011年,它们分配了近8000亿美元.8 million loans to small businesses nationwide. 我们的研究简报提供了关于购买力平价的两个特征的见解:大量相对较小的贷款和最初短期救济的持续时间.

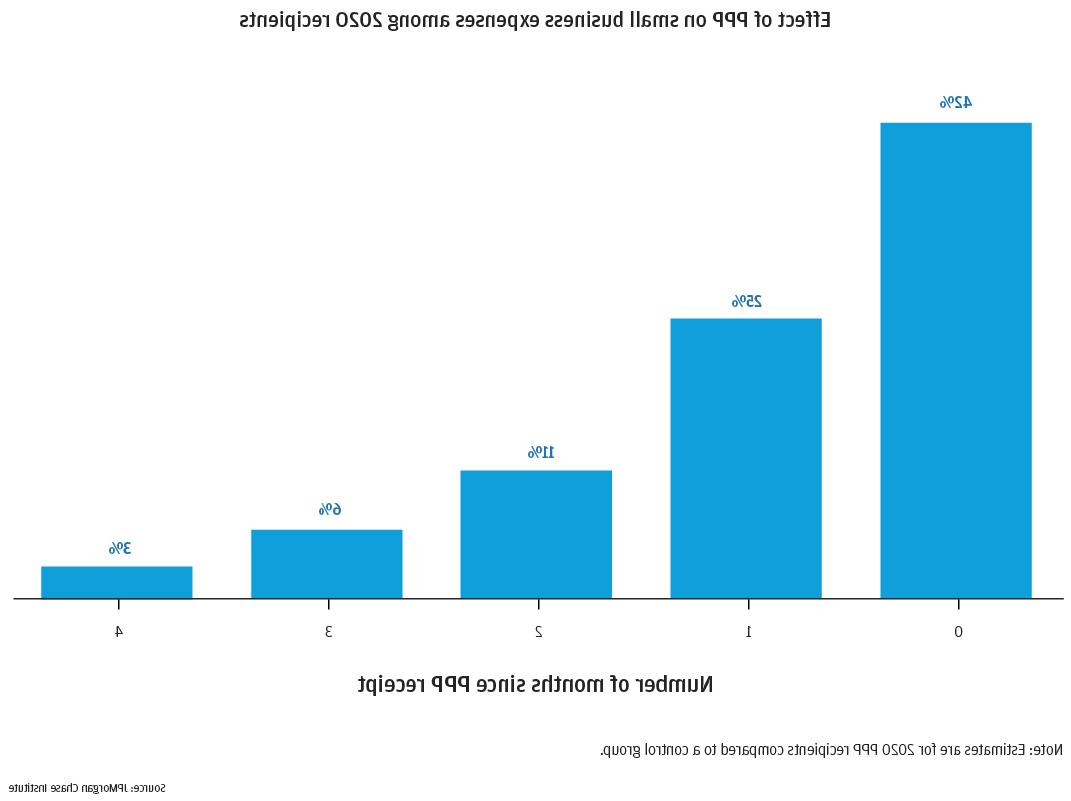

我们分析了购买力平价对企业经营活动的影响程度和持续时间, as measured by expenses. Our findings shed light on the effects of smaller loans, in contrast to other studies focusing on loans greater than $150,000. 2020年近69%的PPP贷款和2021年87%的PPP贷款为5万美元或以下. We found that upon receipt of PPP funds, 与对照组相比,小企业的开支增加了40%以上, with significant but declining effects over four months.

我们还发现,在规模最小的公司中,这种影响更大, 也许是因为它们比大型银行的流动性更受限. 这项研究将有助于决策者评估支持该计划所需的巨额财政支出,并为未来救济计划的设计考虑提供见解. Click here to read more.

KEY FINDINGS:

Finding 1: Upon PPP receipt, 与对照组相比,小企业的支出增加了40%以上, with significant but declining effects over four months.

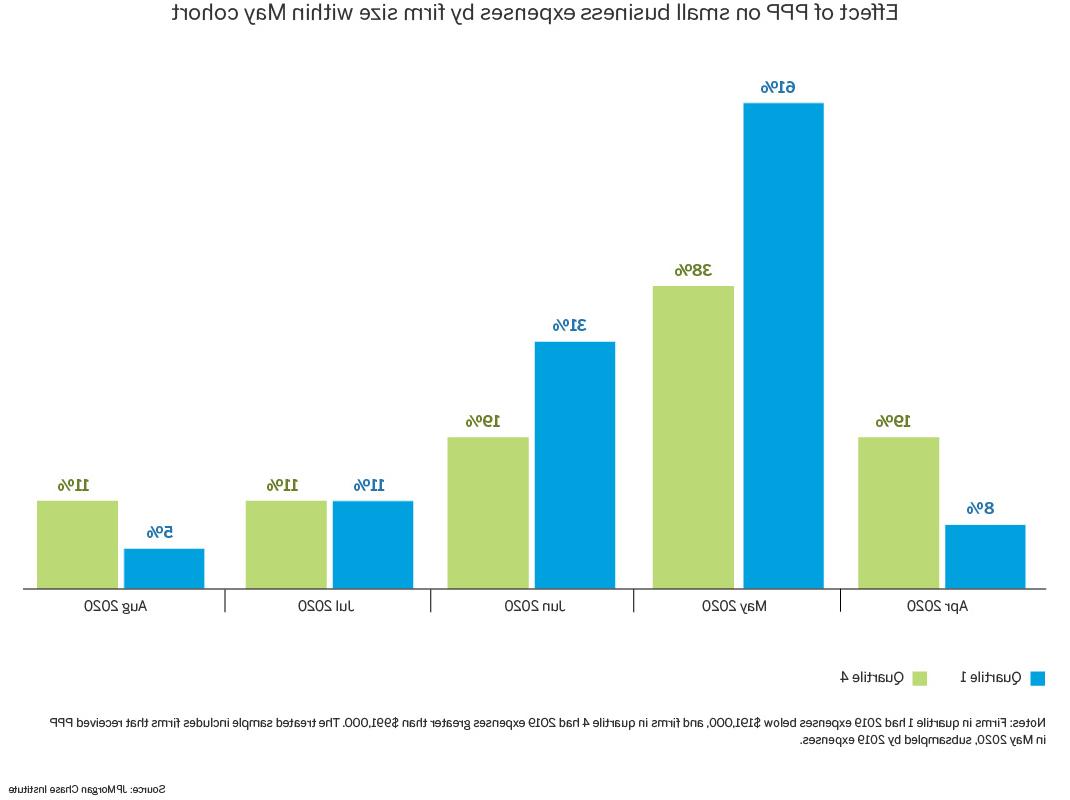

Finding 2: PPP贷款对支出的影响在2020年4月和5月最大, when small business expenses were particularly depressed.

Finding 3: 在收到贷款后,最小的公司经历了更大的支出影响, 也许是因为他们比大公司更受流动性限制.

Finding 4: Restaurants may have used PPP loan proceeds to frontload expenses.

我们感谢Nicholas Tremper和Noah Forougi对这项研究的辛勤工作和重要贡献. 此外,我们感谢艾米丽·拉普和罗伯特·考德威尔的支持. We are indebted to our internal partners and colleagues, who support delivery of our agenda in a myriad of ways, and acknowledge their contributions to each and all releases.

We would like to acknowledge Jamie Dimon, CEO of JPMorgan Chase & Co., 表彰他在建立研究所和推动正在进行的研究议程方面的远见卓识和领导能力. We remain deeply grateful to Demetrios Marantis, Head of Corporate Responsibility, Heather Higginbottom, Head of Research & Policy, 以及公司其他员工的资源和支持,以开创一种新的方法,为全球经济分析和洞察力做出贡献.

本材料是澳博官方网站app研究所的产品,仅供提供一般信息之用. Unless otherwise specifically stated, 此处表达的任何观点或意见仅为所列作者的观点或意见,可能与J .表达的观点和意见不同.P. 摩根证券有限责任公司(JPMS)研究部或澳博官方网站app的其他部门或部门 & Co. or its affiliates. This material is not a product of the Research Department of JPMS. 消息来源被认为是可靠的,但澳博官方网站app & Co. or its affiliates and/or subsidiaries (collectively J.P. Morgan) do not warrant its completeness or accuracy. 截至本材料发布之日,意见和估计构成我们的判断,并可随时更改,恕不另行通知. 本报告所依赖的数据是基于过去的交易,可能不代表未来的结果. 此处的意见不应被解释为对任何特定客户的个人推荐,也不打算作为对特定证券的推荐, financial instruments, or strategies for a particular client. 本材料不构成招揽或要约在任何司法管辖区,这种招揽是非法的.

Wheat, Chris and Chi Mac. 2021. “薪水保护计划支持小企业活动吗??”JPMorgan Chase Institute. http://catalog.865243.com/institute/research/small-business/did-ppp-support-small-business-activity.