请 更新浏览器.

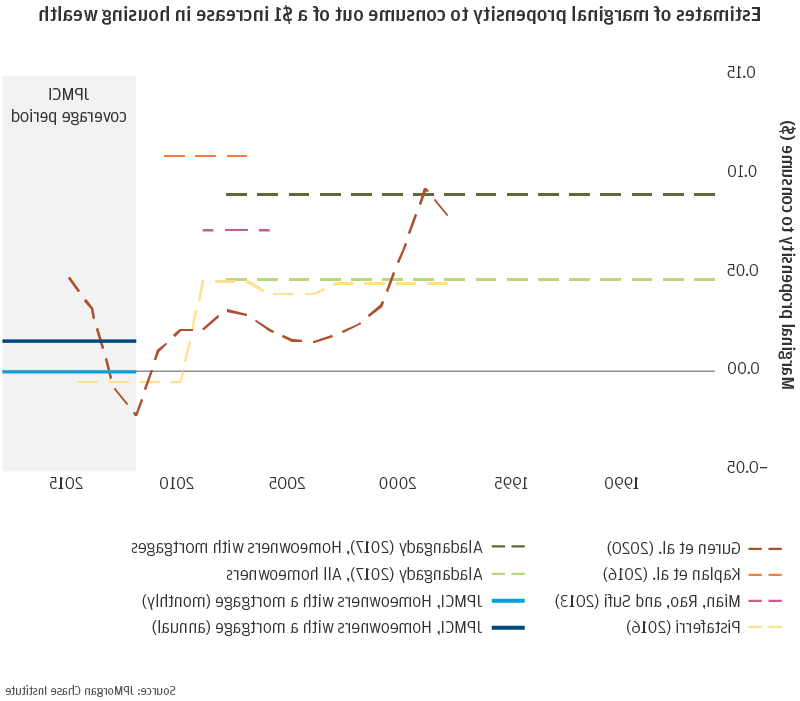

在美国,大约三分之二的家庭都是这样.S. 拥有一个家. Rising home prices, and therefore housing wealth, can fuel household consumption. 像这样, the housing market can have a significant impact on the broader economy. From the late 1990s up to the Great Recession, 住房财富的边际消费倾向(MPC)估计在大约4美分到9美分之间, and studies covering the Great Recession period have found MPCs as high as 11 cents.1 然而, 消费和GDP增长低于预期的证据,加上大衰退后相对较低的房屋净值提取水平,表明金融危机后住房财富效应可能比之前的时期要小得多. 事实上, some recent studies suggest that the MPC may be as low as zero, but these studies do not provide precise causal estimates.

在这份报告中, 我们回答以下研究问题:大衰退后,家庭消费对住房财富增长50%的反应是什么? 我们链接去识别的银行数据, including transaction-level deposit account and credit card data, to loan-level mortgage data to estimate the MPC out of housing wealth for the period between 2012 and 2018. 我们的大样本和直接消费测量使我们能够获得比其他方法更精确的MPC估计.

边际消费倾向是指消费者选择将收入或财富增加的一部分用于购买商品和服务,而不是储蓄.

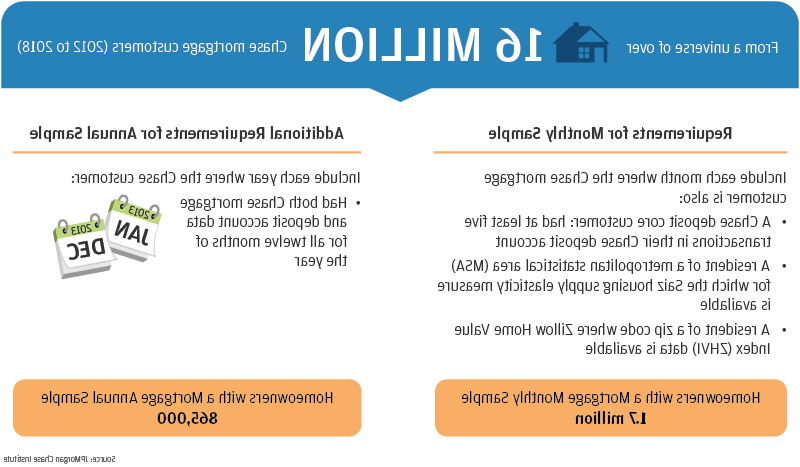

From a universe of over 16 million 追逐 mortgage customers between 2012 and 2018, 样本值为1.在此期间拥有大通抵押贷款和大通存款账户并符合上述其他条件的700万客户. Our loan-level mortgage data allow us to observe details of each homeowner’s loan (e.g.(当前权益水平). 在稳健性检查中, 我们还检查了超过500万大通信用卡客户的样本,根据他们的信用卡申请信息,他们很可能是房主. Following similar studies that estimate housing wealth effect MPCs for prior periods, 我们使用工具变量策略,以住房供应弹性作为工具来推导因果估计.

找到一个: 从2012年到2018年,增加住房财富的边际消费倾向(MPC)在0到1之间.6 cents—much lower than most estimates for prior periods.

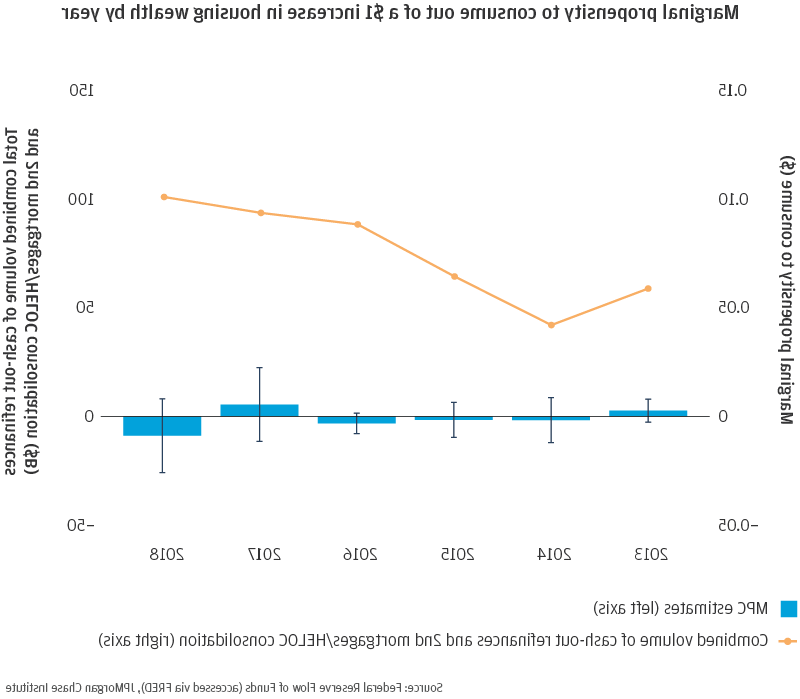

发现二: We estimate a housing wealth effect MPC of near zero for each year between 2013 and 2018.

影响

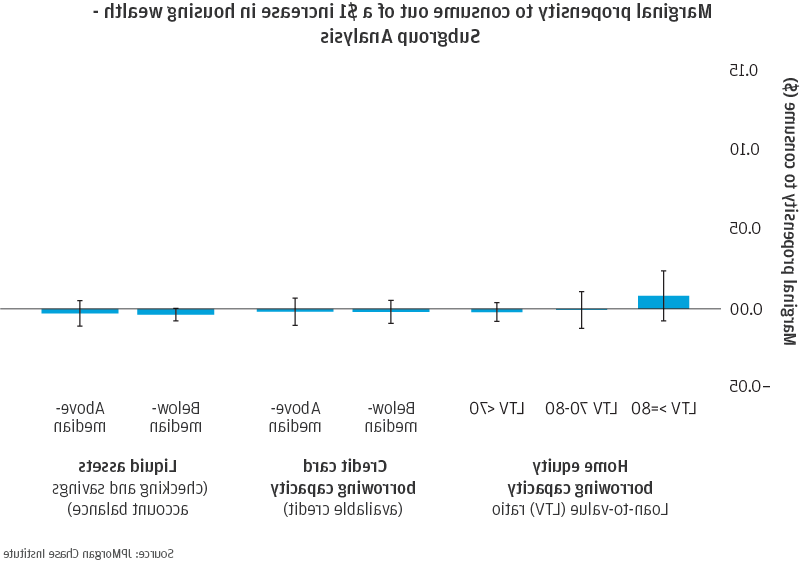

我们如何协调后大衰退时期住房财富中较小的MPC与之前时期较大的MPC? 我们发现,大衰退后时期的股票撤资量远低于房地产繁荣时期. 研究 suggests there are both demand and supply factors at play. 金融危机之后, 更大比例的股权集中在年龄较大、信贷受限程度较低的借款人手中,他们对股权提取的需求往往较低. 同时, 收紧的贷款标准减少了对更多信贷受限的抵押贷款持有人的信贷供应,这些人可能对股权提取有更大的需求. 我们提供了新的证据,表明以房屋净值为抵押借款的需求不足,导致了以住房财富为抵押的边际消费倾向较低:即使是拥有更多股本的房主(对他们来说,贷款应该很容易),在住房财富上升时也不会消费更多.

这项研究对政策制定者有几个影响,在经济面临新型冠状病毒肺炎大流行引发的严重衰退之际,这项研究尤为重要. 第一个, 房主以房屋净值的形式拥有大量非流动性财富,从而进入了新型冠状病毒肺炎危机. 鉴于现金流动态和流动性作为消费决定因素的重要性以及保持住房支付的能力, measures that allow homeowners to preserve or increase liquidity in the face of financial distress, such as through forbearance or maintaining access to this home equity, could provide an important financial cushion. 这些类型的措施带有风险, 然而, as home prices could depreciate in a recession, 房主权益状况的恶化以及收入波动性的增加可能会使借款人更难履行债务义务.

第二个, 较小的住房财富效应削弱了传统货币政策——即短期利率——通过住房市场影响实体经济的能力, resulting in lower consumption and GDP growth than policymakers might have expected or hoped to stimulate. Had the housing wealth effect MPC remained at estimated pre-recession levels, we find that consumption and GDP would have been 0.1 to 1.5%和0.1 to 1 percent higher, respectively, in each of the years from 2012 to 2018.2 像这样, 政策制定者可能需要更多地依赖其他货币政策渠道和非常规措施, as well as fiscal policies that provide households with liquidity during an economic downturn.