Cash liquidity is a critical predictor of small business survival and growth. Cash balances held by a business provide a buffer to absorb unexpected shortfalls in revenues or increases in expenses. While access to credit or other resources can provide some protection, most small businesses have limited access to financing. As a result, cash liquidity is often the first line of defense for a small business.

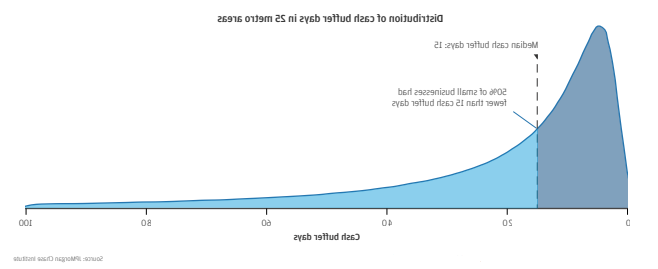

澳博官方网站app 研究所 研究 显示, 50 percent of small businesses are operating with fewer than 15 cash buffer days – the number of days of typical outflows a business could pay out of its cash balance in the event of a disruption to inflows. Moreover, only 40 percent of firms have more than three weeks cash buffer.

Small business cash buffers vary substantially across local economies. The 18 cash buffer days held in reserve by the median small business in 旧金山, 圣荷西 and 西雅图 is over 60 percent higher than the 11 cash buffer days held in reserve by the median business in 亚特兰大 and 奥兰多. Differences in industry mix and the costs of doing business across metro areas do not fully explain the variation in cash buffers.

Our data asset leverages a universe of 1.4 million small operating businesses that use 追逐 Business Banking deposit accounts and allows us to estimate cash buffers by metropolitan area.

Cash Liquidity in 25 Metropolitan Areas

| 市区 | Median Cash Buffer Days | Share with <14 cash buffer days | Share with >21 cash buffer days |

| 旧金山 | 18 | 40% | 43% |

| 圣荷西 | 18 | 39% | 44% |

| 西雅图 | 18 | 40% | 43% |

| 波特兰 | 18 | 42% | 40% |

| 奥斯丁 | 16 | 43% | 40% |

| 芝加哥 | 16 | 44% | 40% |

| 纽约 | 16 | 44% | 39% |

| 哥伦布 | 15 | 45% | 38% |

| 丹佛 | 15 | 45% | 37% |

| 休斯顿 | 15 | 46% | 37% |

| 印第安纳波利斯 | 15 | 46% | 37% |

| 洛杉矶 | 15 | 45% | 38% |

| 圣地亚哥 | 15 | 45% | 38% |

| 达拉斯 | 14 | 46% | 37% |

| 底特律 | 14 | 47% | 37% |

| 拉斯维加斯 | 14 | 48% | 36% |

| 新奥尔良 | 14 | 47% | 36% |

| 凤凰城 | 14 | 47% | 37% |

| 萨克拉门托 | 14 | 48% | 35% |

| 迈阿密 | 12 | 52% | 32% |

| 河畔 | 12 | 53% | 31% |

| 圣安东尼奥 | 12 | 51% | 32% |

| 坦帕 | 12 | 52% | 30% |

| 亚特兰大 | 11 | 54% | 28% |

| 奥兰多 | 11 | 52% | 30% |

The wide variation in the liquidity of small businesses across metro areas highlights the potential for place-based policies that support the liquidity needs of small businesses. 另外, policymakers and advocates could support the small business sector by increasing their focus on helping small business owners manage liquidity and improve their financial resilience. Cash flow management is challenging for small businesses even in a regularly functioning economy. In those conditions, a combination of increased access to credit and trusted guidance to help owners better manage their cash flows can be critically important in helping small businesses build and maintain larger cash buffers. In the face of a large and fast-moving economic shock, policies that quickly provide cash liquidity may be most responsive to the limited cash liquidity many small businesses face.