请 更新浏览器.

对美国企业来说,纳税时间是一个主要的现金流事件.S. 家庭. In a typical year, roughly four out of five filers receive refunds during tax season. 过去JPMCI 研究 在大流行之前已经证明了这一点吗, a tax refund was the single largest cash infusion of the year for 40 percent of families, 差不多相当于六个星期的收入, 并推动了支出和收支平衡的增长.

今年的纳税时间可能会有所不同. The IRS has reported a significant backlog in processing claims, with as many as six million unprocessed individual tax returns as of December 2021. This has prompted warnings from national consumer advocates that taxpayers should expect their 2022 refunds to be delayed. 除了, families are facing a complicated backdrop of strong labor markets, 通货膨胀, 以及减少与大流行相关的联邦援助. Will this tax season provide its usual boost to cash balances and spending?

退税接受者和早期申报者简介

获得退税的报税人往往更年轻, 实得收入较低, 储蓄也会减少, 与那些欠税的人相比. 早期的申请人, likely to be the first to experience any IRS processing delays, 往往是低收入家庭, for whom the tax refund represents an even larger cash flow event. Families who file earliest have cash balances 61 percent lower and incomes 28 percent lower than those who file later.

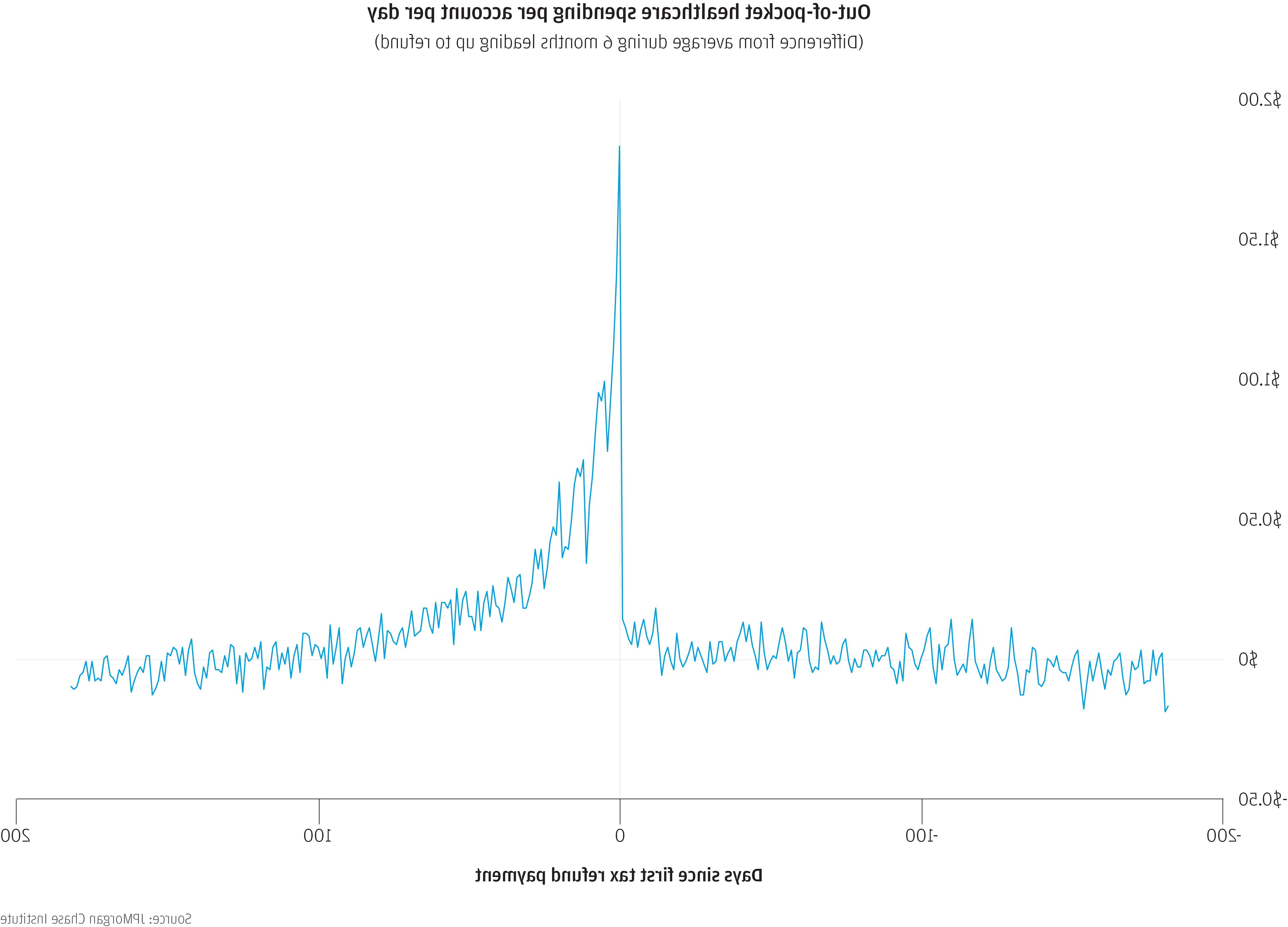

Historically, families depend on the cash infusion from tax refunds to fuel spending. 现金提款, 耐用品采购, and credit payments all increase by 85 percent or more in the week after a tax refund. 但家庭也用他们的退税来满足基本需求, 比如医疗费用和杂货. As shown in the figure below, prior to the pandemic, families 增加 expenditures on out of pocket healthcare costs by 60 percent in the week after refund receipt. Our 研究 shows that cash flow dynamics impact not only when families pay for healthcare but also when they actually receive healthcare, and this may have larger health consequences if families routinely defer care. 值得注意的是, 低收入家庭和早期申报者, 对于他们来说,退款对现金流的影响更大, 增加他们的开支最多. And they spend the largest share of their tax refund on basic necessities like in-person healthcare services.

家庭财务的顺风和逆风

Households face a converging set of headwinds that may impact how families respond to tax time this year. 一方面,进入2022年的家庭收入为 较高的现金结余, 由于2021年的大量财政支持, 包括刺激, 扩大失业救济, 以及提前支付儿童税收抵免. 就业市场, 包括最近的1月份就业报告, 是强大的, with millions of job openings and scattered wage gains starting to appear.

另一方面, price inflation adds a potential draw on the purchasing power of both wage gains and tax refunds. Federal assistance programs aimed at mitigating the worst effects of the pandemic have expired, 比如扩大失业保险和先进的CTC, leaving 家庭 to reckon with the economic impacts of 新型冠状病毒肺炎 more directly. With half of CTC having been paid out in advanced monthly payments, CTC-eligible families may receive a smaller tax refund this year. The Omicron variant, now receding, caused millions to experience work disruptions. The number of people not working because of a 新型冠状病毒肺炎 infection or to care for someone infected rose from three million in the first half of December 2021 to 8.根据人口普查局的数据,到2022年1月初,美国人口将达到700万 data. 没有流行病失业援助计划, many impacted workers had fewer supports to offset those lost wages. 学生贷款延期, 为大约六分之一的成年人提供支付减免, 将于2022年5月到期, 就在税收季节结束的时候.

As policymakers and others continue to assess appropriate fiscal and monetary policy responses, household balances remain an important bellwether for financial stability and resilience. 随着税收季节的展开,我们将继续追踪他们.

This material is a product of 澳博官方网站app 研究所 and is provided to you solely for general information purposes. 除非另有特别说明, any views or opinions expressed herein are solely those of the authors listed and may differ from the views and opinions expressed by J.P. 摩根 Securities LLC (JPMS) 研究 Department or other departments or divisions of 澳博官方网站app & Co. 或者它的附属机构. This material is not a product of the 研究 Department of JPMS. Information has been obtained from sources believed to be reliable, but 澳博官方网站app & Co. 或其联属公司及/或附属公司(统称为J.P. 摩根)不保证其完整性或准确性. Opinions and estimates constitute our judgment as of the date of this material and are subject to change without notice. No representation or warranty should be made with regard to any computations, 图, 表, 本材料中的图表或注释, 哪些只作说明/参考用途. The data relied on for this report are based on past transactions and may not be indicative of future results. J.P. 摩根 assumes no duty to update any information in this material in the event that such information changes. The opinion herein should not be construed as an individual recommendation for any particular client and is not intended as advice or recommendations of particular securities, 金融工具, 或者针对特定客户的策略. This material does not constitute a solicitation or offer in any jurisdiction where such a solicitation is unlawful.