请 更新浏览器.

发现

- 去找1五分之四的受访者收到了一次或多次退款,但没有付款. Refund recipients tend to have lower average incomes and smaller cash buffers than those making tax payments.

- 去找2Tax refunds amount to almost six weeks’ take-home income for the average family receiving them. 对于纳税的家庭来说,平均支付的金额相当于2美元.5周的收入.

- 去找3Among tax refund recipients, average expenditures increase sharply as soon as the refund is received. 退款后六个月, 每个家庭平均还剩下28%的退税.

- 去找4耐用品支出, 信用卡付款, 收到退税后,现金提现的增幅最大.

- 去找5Families for whom the refund has a larger cash flow impact increase their spending and saving most sharply when it arrives.

- 去找6平均, families who make a tax payment cover that payment with cash already available when it is due. Once the payment is made, spending and saving patterns quickly return to their previous steady state.

下载

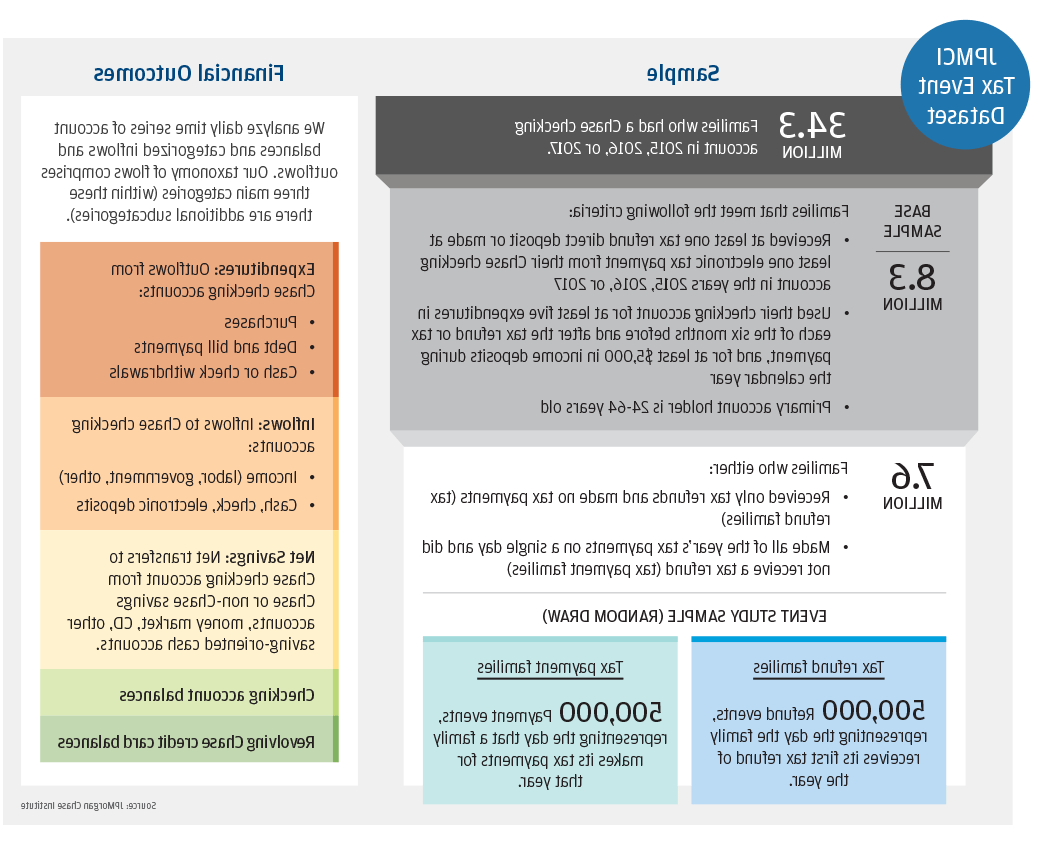

每年春天 more than a half trillion dollars flow into and out of the financial accounts of American families as they reconcile taxes paid against taxes owed for the prior year. 大多数这些流表示2.5 percent of the year’s total GDP–hit families’ financial accounts during the dozen weeks of the traditional tax season from mid-February to mid-May. 在之前的澳博官方网站app研究所的研究中, we reported that out-of-pocket spending on healthcare services jumps by 60 percent in the week a tax refund is received and remains elevated for 75 days. 这份报告建立在那项研究的基础上, investigating more comprehensively how families manage the positive cash flow from tax refunds and negative cash flow from tax payments. We analyze daily financial flows and balances for one million families who receive tax refunds or make tax payments, and find that tax reconciliation has a significant and long-lasting impact on spending and saving patterns of some, 但不是所有的.

我们的发现强调了这样一个事实, 不管是有意还是无意, 税收制度是许多家庭获得一次性现金的主要工具. 他们提出了关于家庭角色的问题, 金融服务提供商, 政策制定者可能会为此目的创造更便宜、更灵活的工具.

找到一个: 五分之四的受访者收到了一次或多次退款,但没有付款. Refund recipients tend to have lower average incomes and smaller cash buffers than those making tax payments.

The vast majority of families in our base sample are "tax refund" families; they received one or more tax refunds and made no tax payments in a year. “纳税家庭”只占少数. In this study we focus on a subset of families making payments—those who make all of their payments in a single day. Tax payment families had higher take-home incomes and larger cash buffers than tax refund families.

发现二: Tax refunds amount to almost six weeks’ take-home income for the average family receiving them. 对于纳税的家庭来说,平均支付的金额相当于2美元.5周的收入.

发现三: Among tax refund recipients, average expenditures increase sharply as soon as the refund is received. 退款后六个月, 每个家庭平均还剩下28%的退税.

发现四: 耐用品支出, 信用卡付款, 收到退税后,现金提现的增幅最大.

平均 payments on non-追逐 credit cards in the week after the refund is received are 86 percent higher than the average during a typical week prior to the refund. 收到退款后,耐用品的平均支出在一周内翻倍, 到50美元,而通常一周只需要25美元. Families also use their tax refunds to deleverage; average revolving credit card balances are almost 8 percent lower in the month after the tax refund relative to the month before.

发现五: Families for whom the refund has a larger cash flow impact increase their spending and saving most sharply when it arrives.

几乎有一半的家庭获得了退税, 退款金额超过所有现金账户中退款前余额的总和. 在这些家庭中, 现金提款, 非大通信用卡账单支付, and durable goods purchases more than triple in the week after the first tax refund is received. 在其他家庭中,这些资金的增长较为温和,不到50%. We also find that those who file earliest in the season increase their spending and saving most sharply when the refund arrives.

发现六: 平均, families who make a tax payment cover that payment with cash already available when it is due. Once the payment is made, spending and saving patterns quickly return to their previous steady state.

Payment families in our sample do not cut expenditures or increase their labor income to cover the payment. 而不是, they transfer cash into their checking accounts during the three weeks leading up to the payment. 不像退款家庭, payment families' expenditures and account balances settle quickly back to the original steady-state after the payment is made.

每年春天, more than half a trillion dollars flow into and out families’ financial accounts as they reconcile taxes paid against taxes owed for the prior year. 在这份报告中, we analyze daily financial flows and balances for one million families who receive tax refunds or make tax payments, and find that these flows have a significant impact on the financial lives of some 但不是所有的.